Relaxation of DSR for subordinated apartment mortgage loans, overcoming additional financial problems with 120% high LTV limit

Relaxation of DSR for subordinated apartment mortgage loans, overcoming additional financial problems with 120% high LTV limit

How do you increase the mortgage limit for your subordinate apartment?

Starting in 2024, stress DSR will be introduced by major banks, and if the borrower’s income is insufficient, lease return loans for additional funds will be rejected. Under the Basel Convention, BIS, the Bank for International Settlements, emphasizes bank soundness in the wake of the global financial crisis and provides liquidity to corporate finance by reducing household borrowing. Private loans have already been combined with credit, cash services, and card loans, which are ordinary people’s finance included in debt due to the introduction of DSR, and if income is insufficient, the ability to repay debts will be classified as low. In addition, mortgage loans that use their real estate as collateral can be blocked even if there is an extra LTV left. Therefore, the difficulty level of new borrowing will be difficult in the future, and it will not be advantageous to applicants. The key was to find out the DSR conditions as advantageous as possible with subordinated apartment mortgage loans.

Relaxation of DSR for residential mortgage loans falling behind in business qualifications

The general living stability funds are 50 percent of the second financial company DSR is 50 percent and more certified than banks.The loan of housing loan has been affected by 10 percent, but 10 percent were suitable for least one’s financial products.Because the income certificate is not just at least 90 million won’t examine the amount of income certificate, the maximum of 9 million won by the highest income insurance fee.If you have been reduced, DSR is reduced, DSR to increase the approval limitation limit.This part said that part is useful to guide and progressive parts of business operators who are guided and progress.The business management money was suitable for a short-term borrowing, but the cost of money, investment money, investment money, investment money, investment money, investment money, and business operations were easy.

What is the difference in interest rates on additional funds returned by financial firms?

The liquidity market began to the United States Federal Reserve System started to say that the U.S. Federal Reserve System is the “zero interest rates” from the country.However, banks companies have also said that the bank company has also been net profitable in April, at the dollar interest rates.The financial authorities have decreased pressure on the financial authorities, but the surface interest is not more strict and the customer who won’t risk, but it is not risk.If there is a loan, you have to reject the examination of the reasons for the purchase of the company, the limit was already used to be used to reject the examination.

The second financial company had an additional interest rate of 1.5-2% considering the rapid change of borrowers, and the range was wide from 6% to 20% legal interest, but it did its best as long as the screening criteria were met. If the credit rating was excellent, subordinated apartment mortgage loans could be used at financial costs that are not much different from commercial bank events.

Importance of Subordinated Mortgage Repayment Periods

In order to use all financial products, the tenant will lead to happiness to the results of use and reimbursement period.If you are progressed in business operations than DSR, the use of the use of the DSR, the use of the financial funds to ensure that the use of the domestic loan.The reimbursement method was evaluated as a plan to be evaluated as a plan of funds and the last financial expenses and the last financial cost of the benefits and the last financial expenses.The first step is important to obtain the approval of DSR and LTV, but it was necessary to receive the necessary amount of money needed to receive the necessary amount of moneyThe reason was for the payment fee.The amount of money that is not used to receive money, and reimbursement period of money and reimbursement period of the tenant’s situation, and the reimbursement period of the result.

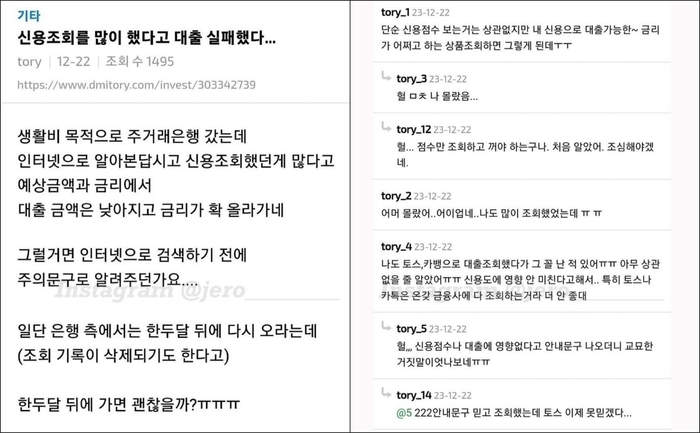

Don’t make excessive inquiries with subordinated apartment mortgage loans

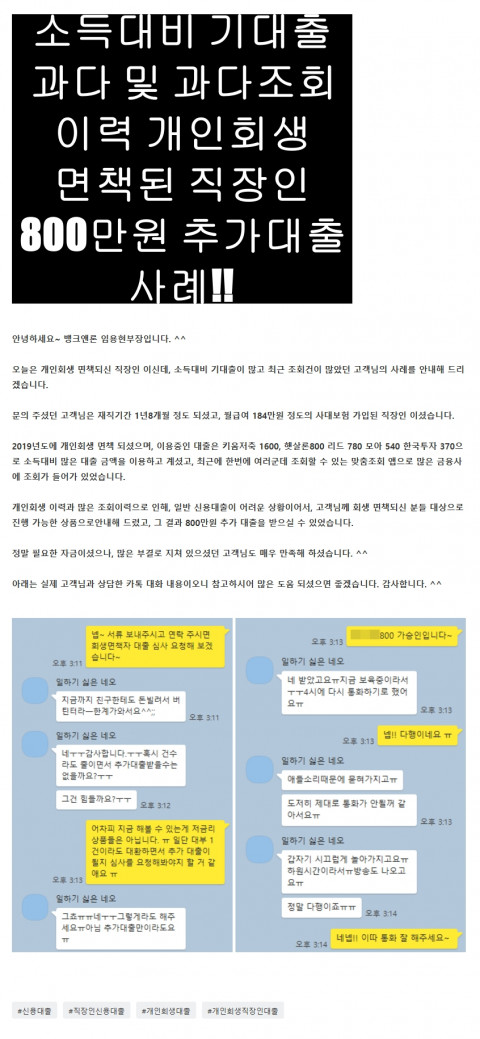

There are many good things about the activation of the Daehwan platform app Beginners had to avoid double-checking other types of apps. In addition, if financial companies guided to the platform access and conduct screening individually, they will also accumulate inquiry records and be classified as excessive credit referrals, which could be considered high-. I received financial consulting from an experienced expert and was selected as the best financial company without a drop in credit rating through inquiries, so I took it easy on the most favorable conditions.

Subordinated mortgage loans in apartments were borrowings that raised a lot of money with high-priced real estate as collateral, so they had to be careful and careful. After receiving a diagnosis of the borrower’s personal financial situation, the screening documents were conducted non-face-to-face The detailed explanation understood all the procedures and it took several days to review because it was a loan in millions, but I was able to wait comfortably.

Subordinated mortgage loans in apartments were borrowings that raised a lot of money with high-priced real estate as collateral, so they had to be careful and careful. After receiving a diagnosis of the borrower’s personal financial situation, the screening documents were conducted non-face-to-face The detailed explanation understood all the procedures and it took several days to review because it was a loan in millions, but I was able to wait comfortably.Subordinated mortgage loans in apartments were borrowings that raised a lot of money with high-priced real estate as collateral, so they had to be careful and careful. After receiving a diagnosis of the borrower’s personal financial situation, the screening documents were conducted non-face-to-face The detailed explanation understood all the procedures and it took several days to review because it was a loan in millions, but I was able to wait comfortably.Subordinated mortgage loans in apartments were borrowings that raised a lot of money with high-priced real estate as collateral, so they had to be careful and careful. After receiving a diagnosis of the borrower’s personal financial situation, the screening documents were conducted non-face-to-face The detailed explanation understood all the procedures and it took several days to review because it was a loan in millions, but I was able to wait comfortably.Subordinated mortgage loans in apartments were borrowings that raised a lot of money with high-priced real estate as collateral, so they had to be careful and careful. After receiving a diagnosis of the borrower’s personal financial situation, the screening documents were conducted non-face-to-face The detailed explanation understood all the procedures and it took several days to review because it was a loan in millions, but I was able to wait comfortably.Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image

![[카오스] 폴딩이 가능해 사용편리한 아기테이블의자_카오스 크랍 하이 체어 추천!! [카오스] 폴딩이 가능해 사용편리한 아기테이블의자_카오스 크랍 하이 체어 추천!!](https://image.gsshop.com/mi09/deal/dealno/222/2018112716567976974.jpg)